News & Insights

Please find our regular insurance & risk management insights detailed below.

Cyber Liability Insurance for the Health Industry Safeguarding Patient Data

In today's digital world, the health sector is under constant threat from cybercriminals. The sensitive nature of patient data makes healthcare organisations prime targets for cyberattacks. With the rise in these incidents, it's becoming increasingly important for...

The Benefits of Comprehensive Insurance for Multi-Tenancy Commercial Properties

Managing multi-tenancy commercial properties can be quite a task, especially when it comes to ensuring everything is covered. With multiple tenants, the risks and complexities multiply, making it essential to have the right insurance in place. That's where...

Comprehensive Insurance for Disability Assistance Services Beyond NDIS

When it comes to providing disability assistance services, having the right insurance is critical. Not only does it protect your business, but it also ensures the safety and well-being of your clients. We’ll explore the various aspects of disability service insurance,...

The Role of Insurance in Safeguarding Clinical Trial Participants

Clinical trial insurance plays a vital role in protecting participants involved in medical research. With the potential for various risks associated with clinical trials, having the right insurance coverage is essential not only for the researchers but also for the...

Emerging Risks in the Health Industry: How Insurance Can Protect Your Practice

The healthcare industry is evolving rapidly, with advancements in technology, regulatory changes, and shifting patient expectations. While these changes bring innovation and growth, they also introduce new risks that medical practitioners and healthcare businesses...

Life Sciences Liability: Why Medical Technology Companies Need Specialised Insurance

The medical technology sector is advancing rapidly, delivering cutting-edge solutions that improve patient outcomes. However, with innovation comes risk. Medical technology companies face unique challenges, from product liability claims to regulatory compliance...

Small Day Surgery: How to Mitigate Risk with the Right Insurance Policy

Running a small day surgery comes with unique risks that require comprehensive risk management strategies. From patient safety concerns to potential legal liabilities, ensuring your practice is protected with the right insurance policy is essential. At Trident...

Insurance Essentials for Disability Assistance Services: What You Need to Know

Running a small day surgery comes with unique risks that require comprehensive risk management strategies. From patient safety concerns to potential legal liabilities, ensuring your practice is protected with the right insurance policy is essential. ...

Protecting Your Commercial Property: The Impact of Increased Building Costs on Insurance Coverage

In an era of rising building costs, commercial property owners face growing challenges in ensuring their insurance coverage adequately protects their assets. Increased costs for materials & labour often mean that outdated policies leave businesses vulnerable to...

Why Reviewing Your Commercial Property Tenancies is Crucial in a Changing Market

In the ever-changing commercial property market, regular tenancy reviews may play a crucial role. Shifting tenant needs, regulatory updates, and economic conditions could impact profitability, competitiveness, and compliance. At Trident Insurance, we recognise these...

Understanding the Unique Insurance Needs of Social Service Agencies

Social service agencies operate in a complex environment, facing unique challenges that require specialised insurance coverage. These organisations, often dealing with vulnerable populations, need comprehensive protection to safeguard their operations, employees, and...

Celebrating 30 Years of Excellence: The Journey of Trident Insurance Group

Trident Insurance Group is celebrating its 30th anniversary! As we reflect on this significant milestone, we take pride in the incredible journey we have experienced. From our modest beginnings in 1994 with a small team of dedicated staff, we have grown to become a...

Types of Insurance Coverage Needed for Dry Cleaners and Laundromats

Operating a dry cleaner or laundromat comes with its unique set of challenges and responsibilities, particularly when it comes to insurance. The right insurance coverage is not just a legal requirement; it's a vital part of protecting your business against potential...

How to Choose the Best Strata Insurance for You

Understanding strata insurance is more than just a necessity—it's a crucial step in ensuring the longevity and security of your property investment. This guide aims to equip you with the knowledge to select the best policy by addressing topics including the basics of...

Best Practices for Managing Insurance Costs as an NDIS Provider

In the dynamic and highly regulated environment of the National Disability Insurance Scheme (NDIS), providers face numerous challenges, not least of which is managing insurance costs effectively. Insurance, while an operational expense, is also a critical component of...

Navigating the Complexities of Marine Liability and Property Insurance Claims

With the myriad of risks involved in maritime operations, from asset damage to legal liabilities, understanding, arranging and managing these insurance is vital for businesses and individuals in the marine sector. Consequently, navigating & negotiating the...

Strata Insurance and Renovations: Considerations and Coverage Guidelines

At Trident Insurance Group, we understand the complexities and unique challenges that come with managing strata-titled properties, particularly during renovations. As trusted insurance brokers in Perth with over three decades of experience, our focus is on providing...

Understanding Marine Liability Insurance: Coverage and Benefits

Marine liability insurance is a specialised insurance offering designed to provide comprehensive coverage and essential benefits for businesses operating in the maritime industry. These safeguards ensure that marine businesses can operate confidently, knowing they are...

Types of Insurance Coverage Essential for Social Service Organisations

In a world characterised by uncertainties, insurance is essential for Perth's social service organisations. Their noble activities, from hosting events to offering advice, comes with risk. Adequate insurance not only protects against these uncertainties but also...

Key Insurance Considerations for NDIS Providers

In the rapidly evolving landscape of the NDIS sector, providers are met with both rewarding experiences and challenging uncertainties. Their role is undeniably crucial, bridging the gap between the vulnerable and a life filled with dignity and independence. However,...

Key Factors to Consider When Choosing Marine Liability Insurance

Navigating the waters of marine liability insurance can be as challenging as navigating the high seas. Whether you assist in running a yacht club, operate a commercial fishing boat, or run a marina facility, it's imperative to understand that not all marine insurance...

Understanding Strata Insurance: A Comprehensive Guide for Owners and Residents

Welcome to Trident Insurance's comprehensive guide to understanding strata insurance in Western Australia. Strata living comes with its own unique set of complexities, and navigating the insurance landscape can be especially challenging. Whether you're an owner,...

Understanding the Importance of Insurance for Drycleaners and Laundromats

Operating a dry cleaning business or a laundromat involves facing a myriad of potential risks, underscoring the importance of comprehensive insurance coverage. In this article, we explore the insurance landscape for these businesses and how Trident Insurance can...

Construction Insurance – Building Defects or Faulty Workmanship Cover

The Importance of Building Defects or Faulty Workmanship Cover for Businesses Building insurance protects businesses from financial losses resulting from damage to their physical property. This type of insurance can cover a wide range of events, from natural...

Insurance Affordability: Will Companies Start Considering Self-Insurance Programs?

As the cost of traditional insurance programs continues to rise, many companies are starting to consider self-insurance as a viable alternative This shift towards self-insurance is driven by several factors, including rising expenses from inflation, a desire for more...

Risk Management – managing risks to avoid claims and minimise premiums

By adopting risk management strategies, you can lower your premiums and increase your business operations. Every day, small and medium-sized businesses are exposed to risks. These risks can directly affect your day-to-day operations, decrease revenue, or...

Reinsurance – How Reinsurers Dictate The Insurance Industry?

Insurance was created on the idea that the premiums of the masses pay for the claims made by a few. This is a powerful principle. But the challenge arises when the total premium pool does not cover the cost of claims. There are many factors that can cause rising...

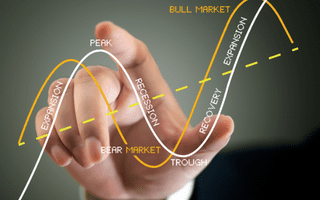

Current Insurance Market Cycle

Understanding the dynamic of the current Insurance market is essential to achieving a good deal at renewal. The insurance market cycle refers to the fluctuations of insurance premiums over time. These fluctuations can be driven by a variety of factors, including...

How To Make Your Manufacturing Business Safer

The Australian Work Health and Safety Strategy has urged the manufacturing sector to lower its rates of fatalities and serious injuries. Learn how Trident Insurance can assist manufacturers in managing the many risks faced by the industry. Manufacturing...

What is Your Extreme Weather Plan?

Can your insurance policy weather the storm? No matter where your business is in Australia, you are likely to be confronted with extreme weather events or natural disasters at some point. There is ample evidence of extreme weather events in Australia, with many...

Cyber Breaches: How Far Behind Is Australia on Cyber Security?

Is the surge in data breaches a result of bad luck, coincidence, or intentional targeting? Indefensible hacks are not the cause of intrusions. The usual suspects are unsecure systems, compromised credentials, failure to quickly patch, everyday account...

Meeting Mental Wellbeing Obligations for Employers & the Impact on Insurance

A mentally healthy workplace puts the same importance on both the physical health and mental health of its employees. Managers who are supportive, responsive, inspiring, and care about their employees' mental well-being make a huge difference to their workplace...

How Is Climate Change Impacting Insurance?

Climate change is already affecting us and our environment in a variety of ways, and its impacts are projected to become more severe over time. Climate change is caused by a number of factors, including human activity. Greenhouse gas emissions from burning...

Industrial Relations Disputes: Employment Practices Liability Insurance

Is your business across its Employment Practices Liability Insurance? If not, you could be exposed to increased risk and potential costs. Employment risks are a major concern for all business owners. This is because Employers could be held accountable for their...

Directors & Officers insurance – Modern risk exposures for board members

Directors and Officers insurance protects the management of your company from liability claims arising out of business decisions and actions. It is no secret that your company needs strong leaders and board members in order to grow. The problem is when these leaders...

Insurance Cycle – Is the end near?

Traditionally, the insurance market cycle follows a 7-10 year trend. To help simplify and explain this process… When premiums increase to a stage where insurers receive strong profits, this leads to new competitors entering the insurance market. This increased...

Marine Transit Insurance Update

While the global transport industry maintained its long-term positive safety record in the past year, Russia's invasion of Ukraine and subsequent cost increases involving large vessels, crew shortages, port congestion issues and the Suez canal obstruction, meant the...

What Are The Insurance Requirements for a Strata Complex?

Commercial and Residential Strata Insurance covers the specific insurance needs of owners of units and offices. Commercial and residential strata insurance is issued to the Owners Corporation (previously Body Corporate). The owners corporation of each property is...

Could your business be the target of a cyber-attack? Here’s why you need Cyber Liability Insurance.

Cyber risk liability insurance helps protect you against claims and supports your profitability in the event of a cyber-attack or breach. Cybercrime is on the rise. The Australian Cyber Security Centre (ACSC) received more than 67,500 cybercrime reports in the...

Claims Inflation: Why are my insurance premiums increasing?

Across the insurance industry, we often see articles regarding the hardening market cycle, largely due to an increase in natural catastrophes around the world. However, there is one item that is often not discussed in great detail, which is claims inflation.Claims...

Dry Cleaning Industry – Insurance Best Practices

It feels like every month we turn on the news, we see a commercial laundry incinerating, which we find is usually due to poor housekeeping. Unfortunately, this negligence of some, has a negative impact on the wider industry, which consists of Laundromats, Dry Cleaners...

Underinsurance in Business: Traps & Pitfalls – How to Avoid Them

Many Australians, especially those who own businesses, discover they don’t have the cover they need in the worst possible circumstances – when they need to claim. In this article we will deep dive into some of the issues we are observing due to businesses not having...

Insurance for the Hospitality Industry – What you need to know

Across Australia, the hospitality sector has faced a number of challenges over the last two years, with several lockdowns. As we now prepare for the return of the hospitality industry, it is now more important than ever to review the insurance you have in...

Western Australia Industrial Manslaughter Laws: Update

In March 2022, it is anticipated that the new Work Health & Safety Regulations will be finalised and introduced in Western Australia. This will now harmonise the WHS regime across Australia, creating greater consistency between each State & Territory. The new...

Yacht Club Insurance – How to protect your Club and its Members

Since 1994, Trident Insurance Group has proudly managed the insurances for marine based Clubs, which includes Yacht Clubs, Rowing Clubs, Fishing Clubs and Power Boat Clubs. Over this time, we have continuously developed and enhanced our insurance offering so that we...

Underinsurance – what is it, why is it important to me & tips on how to fix it

What is it? Simply put, underinsurance (or co-insurance) is when you don’t have enough insurance to cover the replacement value of the items you’re insuring or don’t have insurance at all. According to the Australian Securities and Investments Commission (ASIC), they...

Understanding Boat Builders’ Insurance

From performing hot works at heights, to handling fibreglass, building a vessel involves a number of complex risks. It is, therefore, important that the insurance coverage you choose, comprehensively protects each Builder for the exposures presented. Traditionally, a...

Long Service Award – Cystic Fibrosis

Last week, Trident Insurance Group were proud to receive a Long Service Award from Cystic Fibrosis WA. For the last 15 years, we have made a commitment to this fantastic charity. Throughout those years, we have watched CFWA continue provide a wide range of support...

Personal Cyber Insurance for Families

Following the continual digital transformation of our every day lives, we are becoming even more dependent on technology, but also more exposed. Most children do not have the same cyber security awareness as adults, and can quite easily download ransomware to the...

Resource Industry Sole Traders – Insurance Package

If you are a Contractor or Sole Trader operating in the Mining or Oil & Gas Industry, it is important that you have a cost-effective insurance program, that also provides you with the correct level of coverage to meet the requirements under most resource industry...

Commercial Cleaners – Insurance Package

Commercial Cleaning is a broad industry, with tasks including Office Cleans, Deep Cleans, Chemical Cleaning, Industrial Cleaning, Warehouse Cleaning, Shopping Centre Cleaning and Window Cleaning. It is not uncommon for Commercial Cleaners to offer services to various...

Workers Compensation: Some handy tips to help manage your premiums

Currently in Western Australia, Workers Compensation Insurance is administered by an Act which dates back to 1981. Over the last 40 years, the Workers Compensation landscape has also completely evolved, with new forms of injuries such as mental health and also the...

Avoiding Injuries On The Field And In The Workplace

INTERVIEW WITH FORMER PERTH GLORY PLAYER DINO DJULBIC As we prepare for the 2021-2022 A-League season to kick off, we caught up with former Perth Glory player, Dino Djulbic. Dino played over 400 games of professional soccer, which included playing a couple of games...

Everything you need to know about Marine Liability Insurance

If you are a Contractor that works on boats/watercraft or conducts your business activities on, or near the water, you may need to consider a specialty Marine Liability insurance policy (or alternatively known as Shiprepairers Liability). Generally, all off-the-shelf...

Importance of scaffold insurance!

Trident specialises in protecting a number of high-risk industries, one of which is the Scaffold Industry Why is it important to have the correct Scaffolders Insurance in place? It is no secret that the Scaffold Industry is a high-risk sector, with several...

Exciting Staff Milestone

We would like to proudly congratulate Lenaida McGuiness, on reaching her 10-year anniversary with Trident! Lenaida has had an illustrious career with Trident and is currently involved in managing a broking team and portfolio of Corporate Clients. Her...

Cyber Insurance – How much cover do I need?

Cyber Risk is now one of the main exposures business owners face today. With the growth and reliance on technology, cyber events are also becoming more frequent and the number of claims far greater. In this article, we will dive...

How to manage your insurance premiums in a hardening market

It is no secret that we are in the midst of a hardening insurance market cycle. Given that these increases may continue to occur in the years to come, we thought it was important to remind our customers what steps they can take to help minimise these potential...

Trident boosts Corporate Practice Group with new hire

To meet the growing needs of the business, Trident is pleased to announce the recent appointment of Dan McCallum. Dan joins Trident as an Account Director and will lead our Risk Management Division. Dan is highly experienced and well respected in the insurance...

65 Roses Charity Day

Every year, at the end of May, Cystic Fibrosis WA celebrates 65 Roses Day, where they sell thousands of fresh roses around the state.The origins of 65 Roses day is a touching story, starting when a mother in the US with three boys suffering from Cystic Fibrosis...